1031 exchange calculator

Learn about the many advantages to structuring your transaction as a 1031 exchange. Find Your Ideal Replacement Asset.

Types Of 1031 Exchange Properties Commercial Property Exchange Property

Own Real Estate Without Dealing With the Tenants Toilets and Trash.

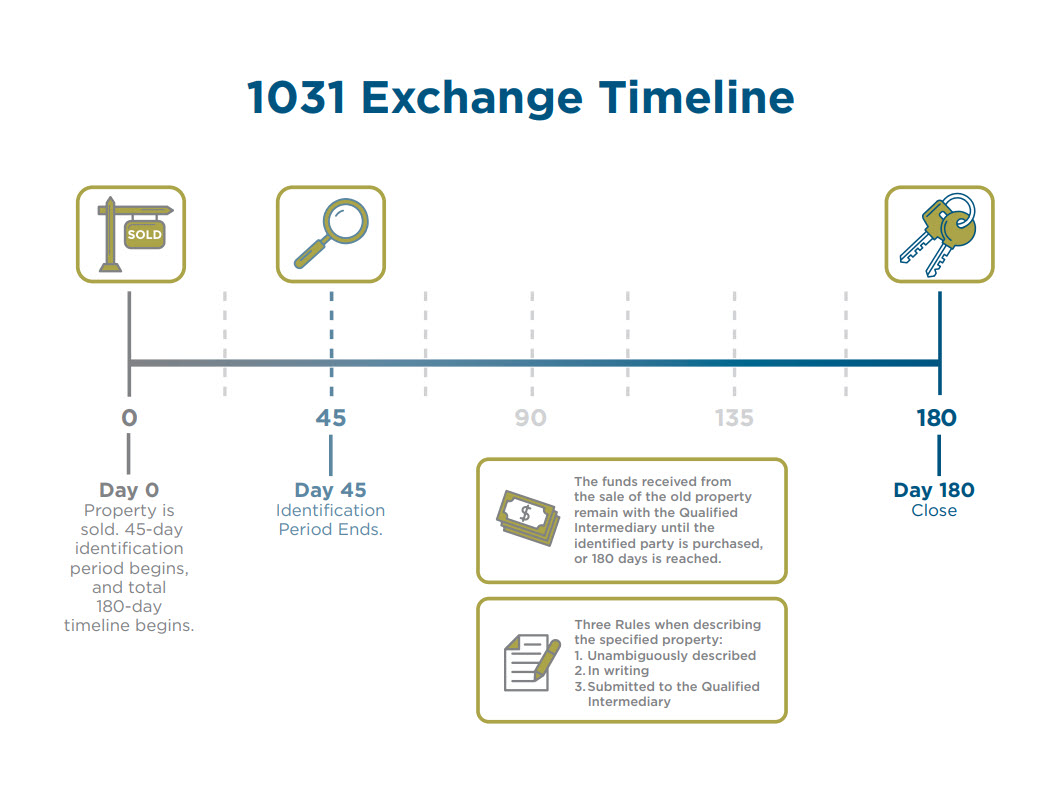

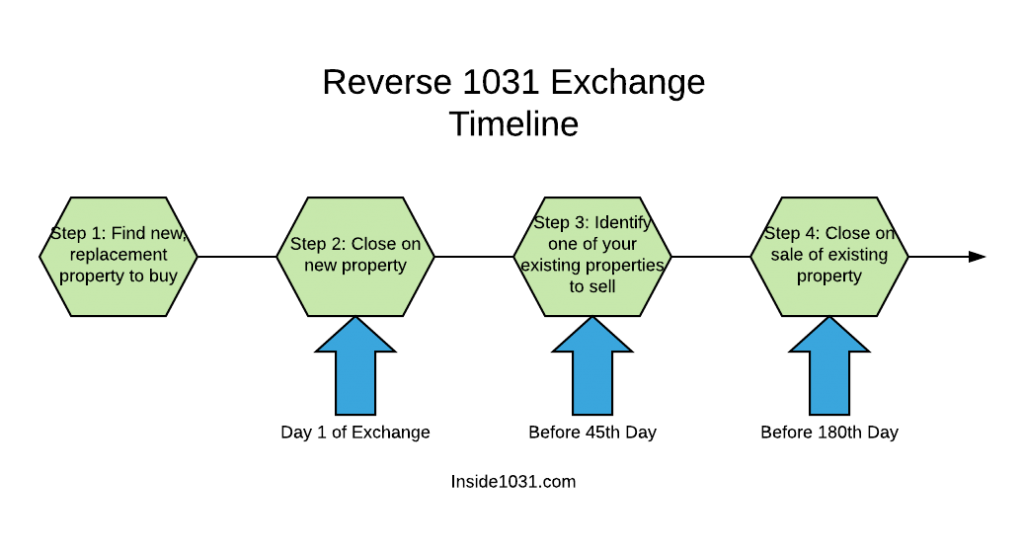

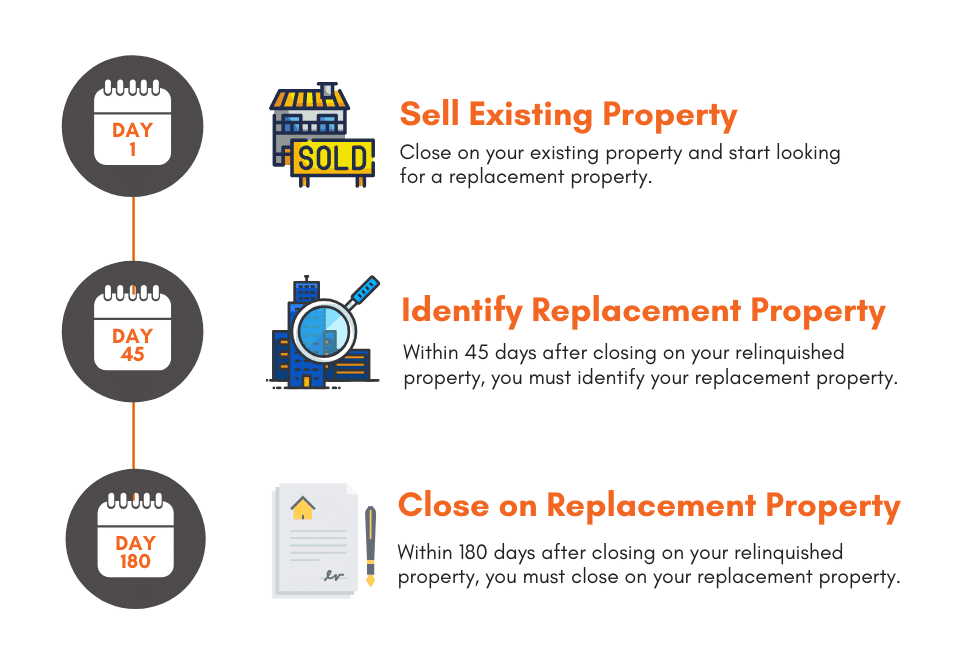

. And the property or. This Capital Gains Tax Calculator estimator is provided to illustrate potential taxes to be paid in a taxable sale versus a 1031 Exchange. You must formally identify potential replacement properties within 45 calendar days from sale.

Own Real Estate Without Dealing With the Tenants Toilets and Trash. 1 877 486 1031. To pay no tax when executing a 1031 Exchange you must.

Find Your Ideal Replacement Asset. To pay no tax when executing a 1031 Exchange you must purchase at least as. You have 45 days after you close escrow to identify potential replacement properties and 180 total days after the close of escrow to close on your.

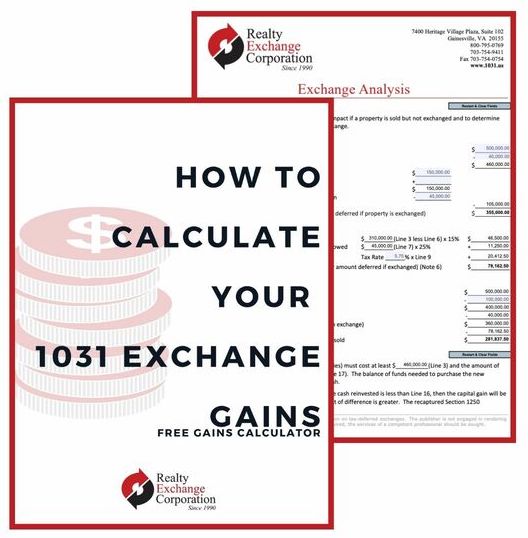

180-day Period Ends on. Everything You Need to Know to Save Paying Capital Gains Tax. This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase.

Click here for your 1031 Exchange Tool Kit including at 1031 checklist qualified intermediary locator close date form 1031 identification form and more. If the investor does not move forward with an exchange then the transfer of property is a sale subject to taxation. Well be happy to help you with calculating your 1031 Exchange please give us a call 215-489-3800.

This simplified estimator is for example purposes only. The maximum exchange period from the closing date of your sale of the relinquished property to the purchase or your replacement property is 180 calendar days. Ad Consult with an expert at the nations largest 1031 Qualified Intermediary today.

In performing a 1031 exchange one must speak to and. Enter the following information and our calculator will provide you an idea of how a 1031. Learn about the many advantages to structuring your transaction as a 1031 exchange.

An investor that holds property longer than 1. Ad Understand the benefits of the 1031 exchange program to defer 100ks in capital gains. Ad 1 Crowdfunding Platform for 1031s.

The IRS places two timing restrictions on any 1031 exchange. Use our exchange date calculator tool to determine your identification and closing deadlines to help you plan your 1031 exchange. Please enter relinquished sale date below and click Calculate 45-day Identification Period ends at midnight of.

A 1031 Exchange requires meeting very strict deadlines for successful completion. Ad Consult with an expert at the nations largest 1031 Qualified Intermediary today. 1031 Exchange Deadline Calculator.

This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. Ad 1 Crowdfunding Platform for 1031s. Use this calculator to help you determine the deadlines for the 45-Day Identification Period and the 180.

1031 Exchange Date Calculator. Cornerstone Combines The Power Of 1031 Securitized Real Estate. Ad With Decades Of Experience Let Cornerstone Help With Your DST 1031 Exchange Today.

The time periods for the 45-day Identification Period and the 180-day Exchange Period are very strict and cannot be extended even if the 45th day or 180th day falls on a Saturday Sunday or. The projections or other information generated by the 1031 Exchange Analysis Calculator regarding the likelihood of various investment outcomes are hypothetical in nature. Youre now undertaking a partial 1031 exchange since youre not reinvesting all the proceeds from the sale.

The new property youve targeted is only priced at 750000.

1031 Exchange Timeline Overview And Considerations Accruit

Life Insurance Is An Asset Learn How To Utilize Yours 1031 Exchange Experts Equity Advantage

What Is The 1031 Exchange Timeline For 2021 Infographic

45 180 Day Exchange Calculator 1031 Crowdfunding

1031 Exchange Calculator Estimate Tax Savings Reinvestment

Brochures And Materials 1031x

Learn The True Time Frame For A 1031 Exchange

How To Do A 1031 Exchange Like A Pro Free Guide

1031 Exchange Rules Real Estate Transition Solutions

![]()

1031 Exchange How It Can Work For Your Properties

1031 Exchange How Do Sales Costs Of Dst S Compare With Traditi Investing Corporate Bonds Selling Real Estate

1031 Exchange Calculator Ramen Retirement

1031 Exchange Capital Gains Tax Calculator Midland 1031

1031 Exchange Calculator With Answers To 16 Faqs Internal Revenue Code Simplified

1031 Exchange Overview And Analysis Tool Updated Apr 2022 Adventures In Cre

Deadline Calculator For 1031 Exchanges

1031 Exchange Savings Calculator